Sustainability transformation in banking

Horn & Company is your partner for the comprehensive and successful implementation of sustainability in the financial industry.

The sustainability transformation – great challenges come with great opportunities

The ecologically necessary and politically supported transformation into a climate-neutral and resource-efficient, green economy is one of the greatest tasks of our time. The necessary public and private investments are enormous and, from a bank’s perspective, this offers attractive opportunities. However, many banks today encounter regulatory challenges associated with this transformation. Our professionals are well-versed with regulatory challenges through their projects. Our clients can thus benefit from a wide range of sustainability-related expertise such as: A pivot point is sustainability-related data, such as greenhouse gas emissions (GHG Scope 1, 2, 3). Banks must start to understand these as “performance indicators”, which are subject to steering and management going forward. They need to be integrated in a bank’s strategy, business model, governance, incentive system, management and control processes, and data management. In case of GHG emissions, net zero targets and transition plans need to be defined and monitored. You may benefit from our target operating models (e.g. for sustainability reporting) or expertise and methodological know how in these fields (e.g. for calculating financed emissions). The opportunities for banks lie in positioning themselves effectively as transformation partners for their customers. You may benefit from our know how for the development of sustainable products or our training concepts for relationship managers. Product-related examples include taxonomy-aligned financing of green technologies, green bonds, ESG reports for customer portfolios, sustainable mandates or impact investing offering.

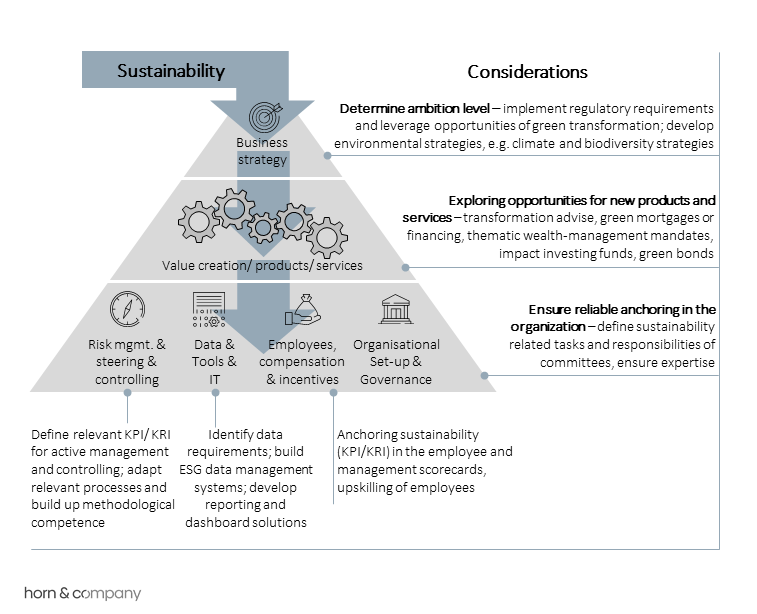

Integrate sustainability along all dimensions of the business-pyramid

Our experts for a successful integration of sustainability

Selected references on the topic of sustainability and banks

state development institutes

Challenge

| A German state-owned promotional bank set itself the goal of anchoring sustainability holistically in its entire business model. The implementation of legal requirements is seen as the necessary first step but the bank wants also to be perceived as an active supporter of the sustainability transformation. To achieve this, the bank aims to assess its operations and business practices against relevant ESG standards. They want economic, ecological and social aspects to be jointly considered and assessed. |

Solution Strategy

Horn & Company successfully supported the promotional bank on their journey and co-created their sustainability strategy with them. As part of the implementation, several steps were taken, including evaluating the introduction of an environmental management system (ISO 14001 and EMAS), conducting an initial analysis of the forthcoming sustainability reporting requirements under CSRD/ESRS, and aligning their own investments (treasury book) with sustainability criteria. The investment strategy was adjusted and an exclusion list was defined. An SDG mapping was conducted for the client’s business, including the funding programs, to quantify their contribution to the UN Sustainable Development Goals. For instance, programs with a social objective or promoting circular economy did play a role in this contribution. To manage sustainability-related topics centrally and efficiently in the future, corporate governance processes have been adjusted. |

private banks

Challenge

A medium-sized German private bank has little sustainability experience in their credit business and wanted to prepare for new regulatory requirements (especially EBA GLoM). In addition to meeting regulatory requirements, they aim to engage in sustainability discussions with their credit clients on an equal footing. |

Solution Strategy

Horn & Company conducted a sustainability project for the private bank, involving both, representatives from the front offices as well as credit officers, in depth. This approach ensured a comprehensive understanding of sustainability, ESG standards and scores for all participants. In particular, the front representatives were equipped to explain the new requirements and their implications to their credit clients effectively. As a result, the credit processes were adjusted and the integration of ESG scores was successfully implemented. The ESG data required for the credit decisions was obtained from a specialized, external data provider. Horn & Company assisted in selecting the provider through a comprehensive market survey (RfI/ RfP). |

private banks

Challenge

| A Swiss private bank with an international footprint encounters significant regulatory challenges related to sustainability. These challenges are complex and differ between jurisdictions. Examples include sustainability reporting (CSRD/ ESRS, Swiss Code of Obligations, IFRS/ISSB) or the prudential requirements for climate risk consideration in risk management (EBA/ ECB, BaFin, FINMA). |

Solution Strategy

Horn & Company was able to support the private bank with all challenges: Firstly, a regulatory monitoring and assessment process was established and a specialized, external partner was selected for the monitoring of global regulatory developments. The subsequent analysis of regulations’ applicability was then anchored with internal legal experts, who could now fully focus on this task. Secondly, an impact analysis of non-financial reporting requirements was carried out and the implementation of CSRD/ESRS was recommended at group level. As part of the implementation, Horn & Company implemented the future target operating model. Thirdly, Horn & Company assisted in refining the risk management framework to better address climate risks. Climate risks can now be analyzed in a more detailed manner as drivers of existing risk types (e.g., market or reputational risk), with separate assessments for physical and transitional aspects, and across short, medium, and long-term time horizons. |